China is quietly seizing financial control of critical minerals, Plus DeepSeek crashes confidence in Silicon Valley -- China Boss News 1.31.25

Newsletter

What Happened?

A new report from AidData at the College of William & Mary reveals that China has quietly tightened its financial grip on critical minerals essential for the global energy transition and net-zero goals. This control has been expanded through 26 state-backed financial institutions.

Using a dataset covering 93 loan commitments and one grant from 86 Chinese and non-Chinese financiers to 59 recipients, AidData's Power Playbook examines China's strategy for embedding itself in global mineral supply chains.

One of the report's most striking findings is China's increasingly covert approach—prioritizing lower- and middle-income countries rich in essential minerals while keeping its Belt and Road Initiative (BRI) financing largely out of public view.

Section 2 of the report highlights Beijing's evolving strategies, key players, and financial tools that allow it to dominate the shift from fossil fuels to renewables. The researchers emphasize China's ability to leverage its vast foreign exchange reserves to meet infrastructure needs while simultaneously securing strategic mineral access.

"Although Beijing has shielded its 'shadow playbook' for transition minerals from public scrutiny, this report follows the money to uncover key features of its strategy" (p. 12).

According to Brooke Escobar, head of AidData's Chinese development finance program, China's financing model allows its companies to outmaneuver competitors in capital-intensive mineral sectors. Without a strong response, rivals will struggle to counter China's dominance.

In 2023 alone, Chinese firms invested $16 billion in foreign mines, the highest level in a decade.

Why It Matters.

China's silent takeover

China has secured its dominance by removing barriers to entry for its firms, providing billions in acquisition loans that give Chinese companies an edge in the global mineral market.

Unlike traditional state-to-state lending, 81% of China's transition mineral loans now go to private firms and joint ventures, making its financial footprint harder to track.

To further minimize financial risks, China has shifted from policy banks to state-owned commercial banks, increasingly relying on syndicated loans shared with non-Chinese creditors.

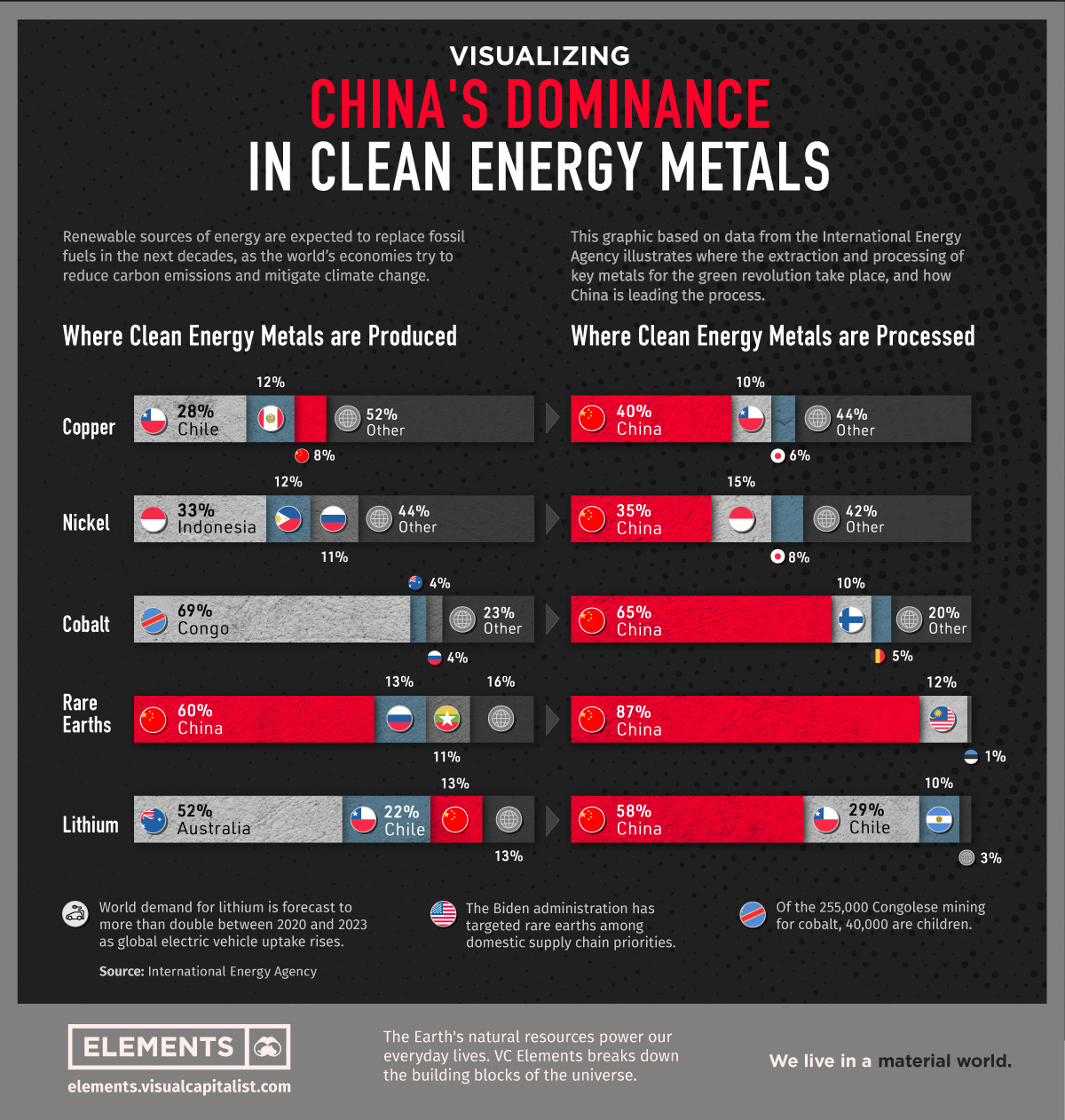

The strategy grants Beijing long-term, quiet control over crucial mineral reserves, including copper from the Democratic Republic of Congo (DRC), nickel from Indonesia, and lithium from Argentina.

At the same time, China is repurposing its Belt-and-Road Initiative (BRI) financing to expand exploration and mining in mineral-rich participant countries.

A key mechanism? The Resource-for-Infrastructure (RFI) model—where China provides infrastructure loans in exchange for long-term mineral access.

The DRC serves as a prime example, receiving massive Chinese funding for infrastructure while granting Beijing control over its vast cobalt reserves, a critical mineral for battery production.

The alternative supply scramble

According to the report, China's state-owned enterprises (SOEs)—including China Molybdenum, Chinalco, and CNOOC—are pivotal in securing overseas mineral assets.

Once they establish a foothold, Chinese state-owned banks provide continuous financing to sustain and expand operations. Between 2000 and 2021, 66% of Beijing's official lending for transition minerals went to 14 major mining sites across eight countries, many receiving multiple rounds of loans.

But China's dominance isn't just in extraction—it also controls processing and refining:

73% of the world's cobalt refining

68% of global nickel refining

59% of lithium refining

This allows China to dictate global prices, limit availability, and impose export restrictions at will.

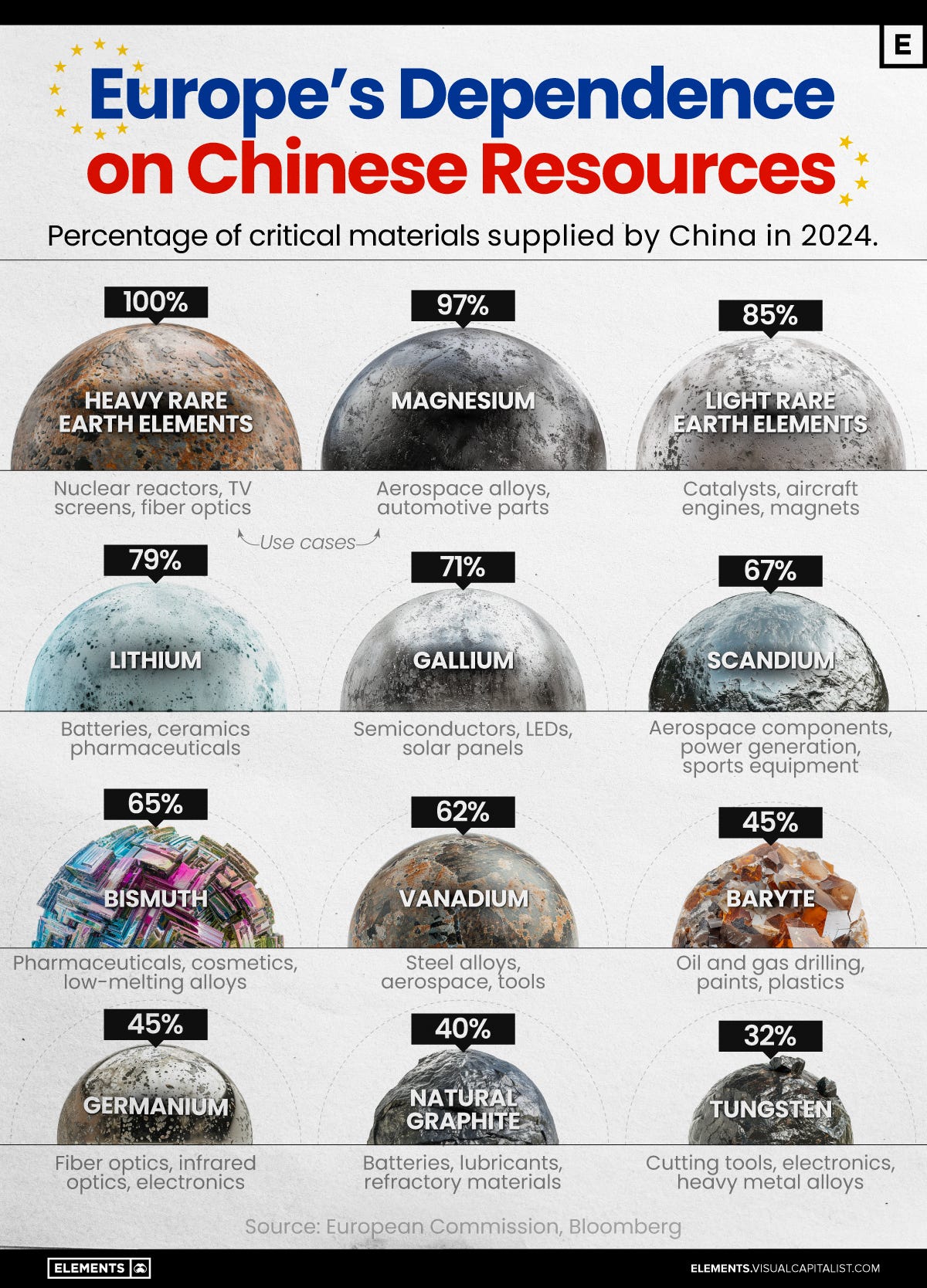

Recent Chinese export bans on antimony, gallium, graphite, and rare-earth metals—all critical for defense and clean energy—have sent shockwaves through global markets.

Experts now fear China could weaponize tungsten, essential for military tech, semiconductors, and industrial applications.

Read more about that in a write-up I did last August.

Western nations are scrambling to counter China’s grip on critical minerals through initiatives like The Minerals Security Partnership (MSP) and the Partnership for Global Infrastructure and Investment (PGII).

They are also increasing domestic production and looking for alternative supply chains. However, China’s deep entrenchment makes this an uphill battle.

Many resource-rich countries depend on Chinese investments, making it difficult to shift toward new partners.

To break Beijing’s hold, AidData’s researchers recommend:

✅ Tighter foreign investment reviews to monitor Chinese acquisitions in mineral sectors

✅ Greater investment in alternative sources of transition minerals

✅ Stricter disclosure rules for Chinese-backed mining projects

✅ Competitive financing to help local firms reduce reliance on China

✅ Building national stockpiles to guard against supply disruptions

Most importantly, the US, EU, and their allies must GET THEIR ACT TOGETHER and align policies so they can act collectively to prevent China from maintaining uncontested control over the world’s critical minerals.

This Week's China News

The Big Story in China Business

DEEPSEEK CRASHES CONFIDENCE IN SILICON VALLEY: DeepSeek, a Chinese AI startup founded in 2023, made headlines last week for performance levels rivaling top Western counterparts such as OpenAI's ChatGPT, with significantly lower costs.

DeepSeek has challenged conventional notions of AI requiring vast computational power and energy.

Keep reading with a 7-day free trial

Subscribe to China Boss News to keep reading this post and get 7 days of free access to the full post archives.