China wants to write the world's AI rules, Plus Chinese firms hunt for new markets as Trump's tariffs bite -- China Boss News 8.08.25

*🍹China Boss will be on break from August 11 to 22. Next newsletter posts August 29. See you soon!

What happened?

Just days after Washington unveiled its blueprint to secure AI supremacy, Beijing fired back with a sweeping counter-proposal—this time from the stage of the World Artificial Intelligence Conference in Shanghai.

Premier Li Qiang called for a “broad consensus” to prevent AI from becoming a geopolitical weapon wielded by the few, a thinly veiled swipe at U.S. chip sanctions and export controls.

As humanoid robots mingled with global tech elites, China launched a new international AI hub, pressed for UN-led dialogue, and showcased its ambition to shape not just the future of technology—but the values encoded within it.

Meanwhile, Trump, speaking from Scotland, claimed the U.S. is “very close” to a trade deal with Beijing.

That comes after both sides appeared to blink: the U.S. agreed to ease some restrictions on Nvidia’s AI chips, and China suspended its antitrust probe into DuPont.

Why it matters.

🇨🇳🤖 AI Governance with Chinese Characteristics

With the U.S. pulling back from multilateralism, China is exploiting the void.

Premier Li Qiang’s remarks and Beijing’s 13-point Global AI Governance Action Plan are part of a broader diplomatic effort to position China as the “responsible” AI leader—especially appealing to countries in the Global South.

Behind the scenes, a new coalition is emerging, co-led by China, Singapore, the UK, and the EU, in forums once dominated by Washington.

As U.S. AI policy veers toward ideological exceptionalism and anti-regulatory orthodoxy, China is branding itself as the adult in the room—pushing for safety, cooperation, and standards.

Yet this charm offensive conceals deeper truths.

China's AI “safety” regime is inseparable from censorship and Party control.

Developers are required to embed “socialist core values” into models and avoid “sensitive topics.”

While Chinese academics call for global collaboration, the state’s goal is clear: to encode its worldview into the architecture of global AI.

Meanwhile, as U.S. labs chase AGI breakthroughs, China is betting on mass deployment.

From military hospitals to local police departments, AI tools like DeepSeek are already being embedded into public sector workflows—albeit sometimes more for show than scale.

The government strategy is twofold: train models on vast government datasets, and use real-world uptake to boost legitimacy at home and abroad.

But that doesn’t make China’s leadership a certainty.

China’s AI economy is also under pressure. Funding is drying up, the tech sector is still haunted by regulatory crackdowns, and local adoption often lags behind propaganda.

Yet by aggressively promoting open-source alternatives, China is nudging U.S. tech giants toward a transparency they've long resisted—and reframing value as not just innovation, but influence.

Boiled down, Li’s announcement is part of the great power struggle over who gets to embed their values into the foundations of tomorrow’s digital order.

And as AI begins to permeate everything from justice to journalism, that contest is getting harder to ignore.

🇨🇳💻 Instruments of Sovereignty

That’s why former Google CEO Eric Schmidt’s plea for U.S.–China AI cooperation felt increasingly out of step.

When Schmidt took the stage in Shanghai to call for U.S.–China cooperation on AI, it felt almost nostalgic.

Appearing alongside Microsoft’s Harry Shum, he urged global unity to confront the existential risks posed by runaway AI systems. “This is a problem faced by all humanity,” he warned, calling for consensus in an increasingly fragmented world.

But the applause echoed across a deepening rift.

Xi Jinping isn’t pursuing cooperation for its own sake.

His approach to global AI governance is deeply rooted in domestic political control—insisting that AI systems reflect Party-approved values and reinforce what the state calls ‘positive energy.’

In this context, technical standards become instruments of sovereignty—and Xi, as an authoritarian leader, has little incentive to yield ground.

Which is why, behind the humanoid mascots and ‘win-win’ diplomacy at WAIC, a standards battle now simmers alongside the chip war.

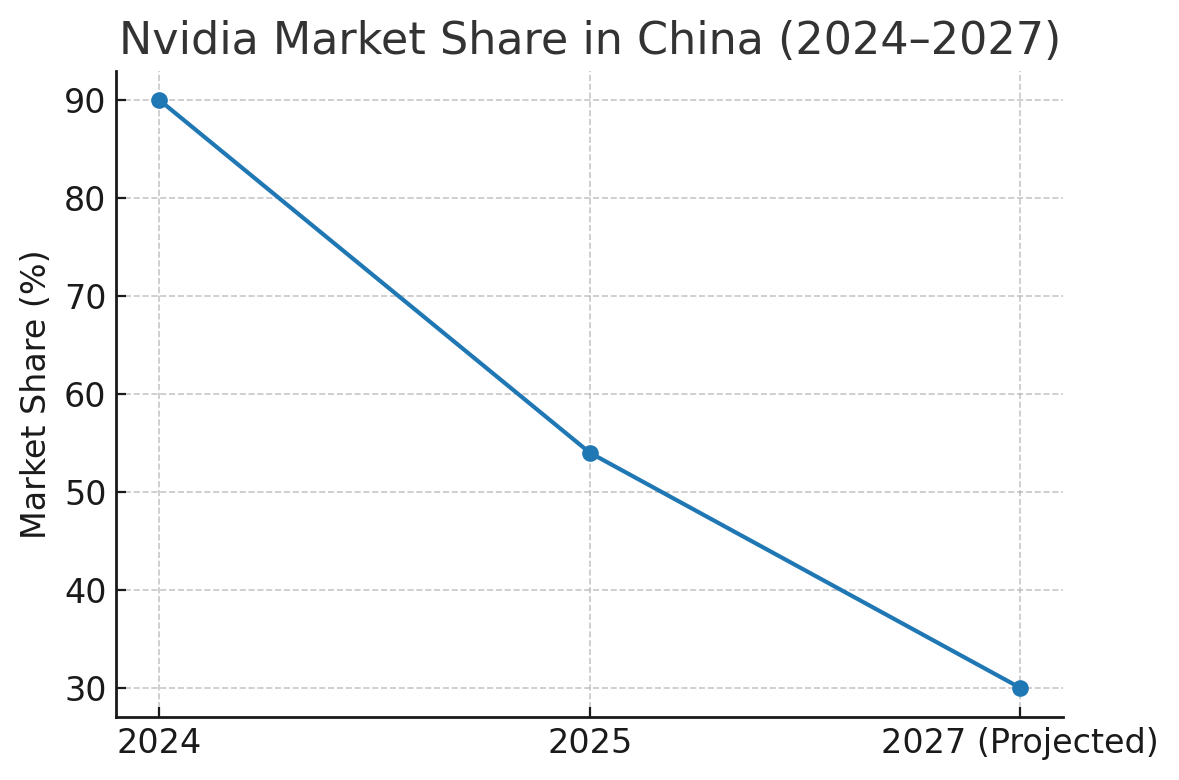

The U.S. has conditionally greenlit sales of Nvidia’s H20 chips to China, betting that mid-tier access might buy time and leverage.

But some argue it’s already too late. Since Washington’s latest export ban, Huawei and Cambricon have gained ground.

Wall Street research firm Bernstein now expects Nvidia’s market share in China to drop to 54% this year; by 2027, most AI chips used in China could be domestically produced.

Meanwhile, Beijing is keeping score.

The Cyberspace Administration has already summoned Nvidia over “security concerns”—a clear reminder that China’s openness is always tactical, often weaponized, and granted only as long as it serves Beijing’s interests.

China is pursuing unfettered access to global technologies, talent, and markets—not dependency. It wants to call the shots. And it's making rapid progress.

Yet U.S. firms still lead in scale: $109 billion in AI investment last year—twelve times China’s, according to Stanford’s Human-Centered AI Center.

But the race to dominate the rules that govern computation is just getting started.

After all, true power lies not in the engineering of stronger models, but in the clout to define their limits and the values that shape them from within.

This Week's China News

The Big Story in China Business

CHINA HUNTS NEW MARKETS AS TRUMP’S TARIFFS BITE: China’s independent oil firms are muscling into Iraq’s once tightly held market, solar giants are quietly laying off tens of thousands, and Beijing just ended a decades-long bond tax exemption—sending ripples through its $21 trillion debt market.

Meanwhile, Trump’s tariffs are redrawing global trade routes once again, prompting China to deepen ties in Brazil, Africa, and even outer space.

And as U.S.–China talks inch forward on rare earths, China’s grip on copper may be starting to slip. Here’s the breakdown.

🛢️ Crude ambition, fading solar: While China’s major state-owned oil firms have long operated in Iraq, it’s the country’s independent refiners—once confined to domestic margins—who are now striking upstream deals in Baghdad.

Keep reading with a 7-day free trial

Subscribe to China Boss News to keep reading this post and get 7 days of free access to the full post archives.